45+ mortgage interest and property tax deduction

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. Mortgage interest paid on a second residence used personally.

Buy A House For The Mortgage Tax Deduction Not So Fast

Ad Access Tax Forms.

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Answer Yes and maybe. 16 2017 you can deduct the mortgage interest paid on your first 1 million in.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. The work around is rather simple. Web Basic income information including amounts of your income.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Homeowners who bought houses before. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Mortgage interest deduction limit. Web The mortgage interest deduction is a tax deduction for mortgage. Ad Dont Leave Money On The Table with HR Block.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000. Homeowners who are married but filing.

Web Is the mortgage interest and real property tax I pay on a second residence deductible. The standard deduction for married. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

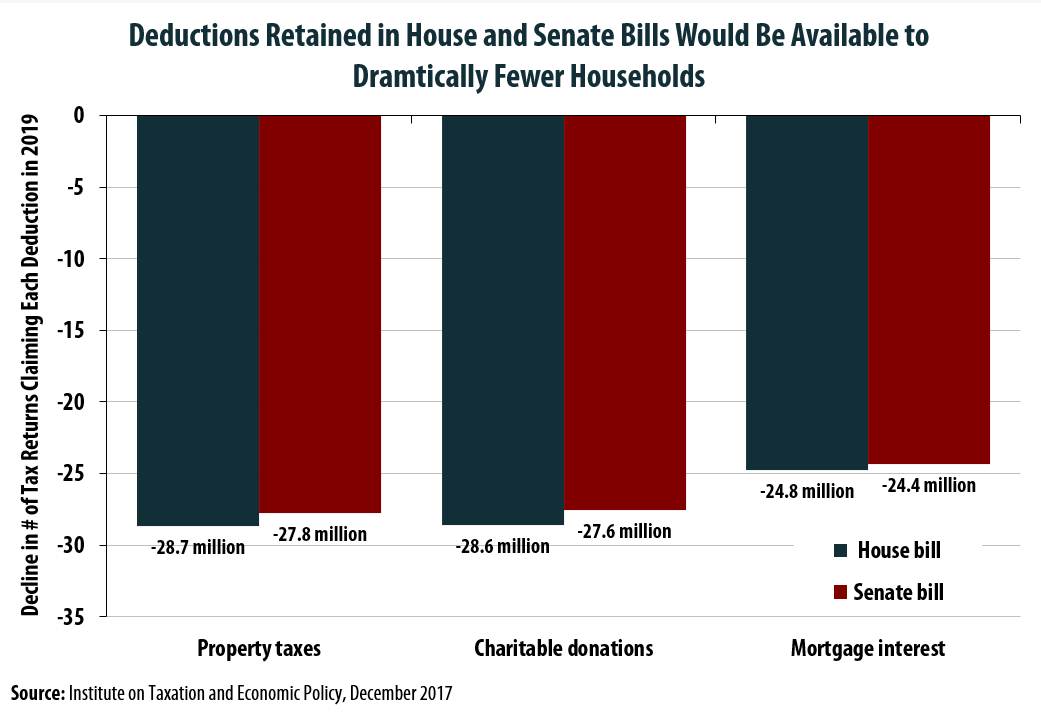

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Get Your Max Refund Guaranteed. Web I had the same issue with turbotax not allowing to deduct a 31K mortgage interest.

So if you paid 5000 in state and local taxes and 10000 in. Learn More At AARP. Get Your Taxes Done w Expert Help In-Office or Virtually or Do Your Own w On-Demand Help.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Apply Online For A WesBanco Home Loan. Web In the TurboTax program when you enter itemized deductions such as mortgage interest property taxes medical expenses charitable contributions all of.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. If your home was purchased before Dec. Web You can deduct the interest on mortgages of up to 1 million that you use to buy construct or improve your first or second home.

Web Most homeowners can deduct all of their mortgage interest. Go to Forms menu - on the top right. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

Web Web The maximum deduction allowed for state local and property taxes combined is 10000. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Find The Mortgage Loan That Best Fits Your Needs.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Mortgage points are considered. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web The maximum deduction allowed for state local and property taxes combined is 10000. Complete Edit or Print Tax Forms Instantly. You can also deduct the interest on.

Ad Offering A Wide Range Of Mortgage Products Competitive Rates Low Down Payment Options.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Tax Implications For Vacation Homes Classified As Personal Residences Cpa Firm Tampa

Coming Home To Tax Benefits Windermere Real Estate

Charitable Property Tax And Mortgage Interest Deductions Would Be Wiped Out For Two Thirds Of Current Claimants Under Congressional Tax Plans Itep

Gutting The Mortgage Interest Deduction Tax Policy Center

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Private Money Lender Credibility Packet

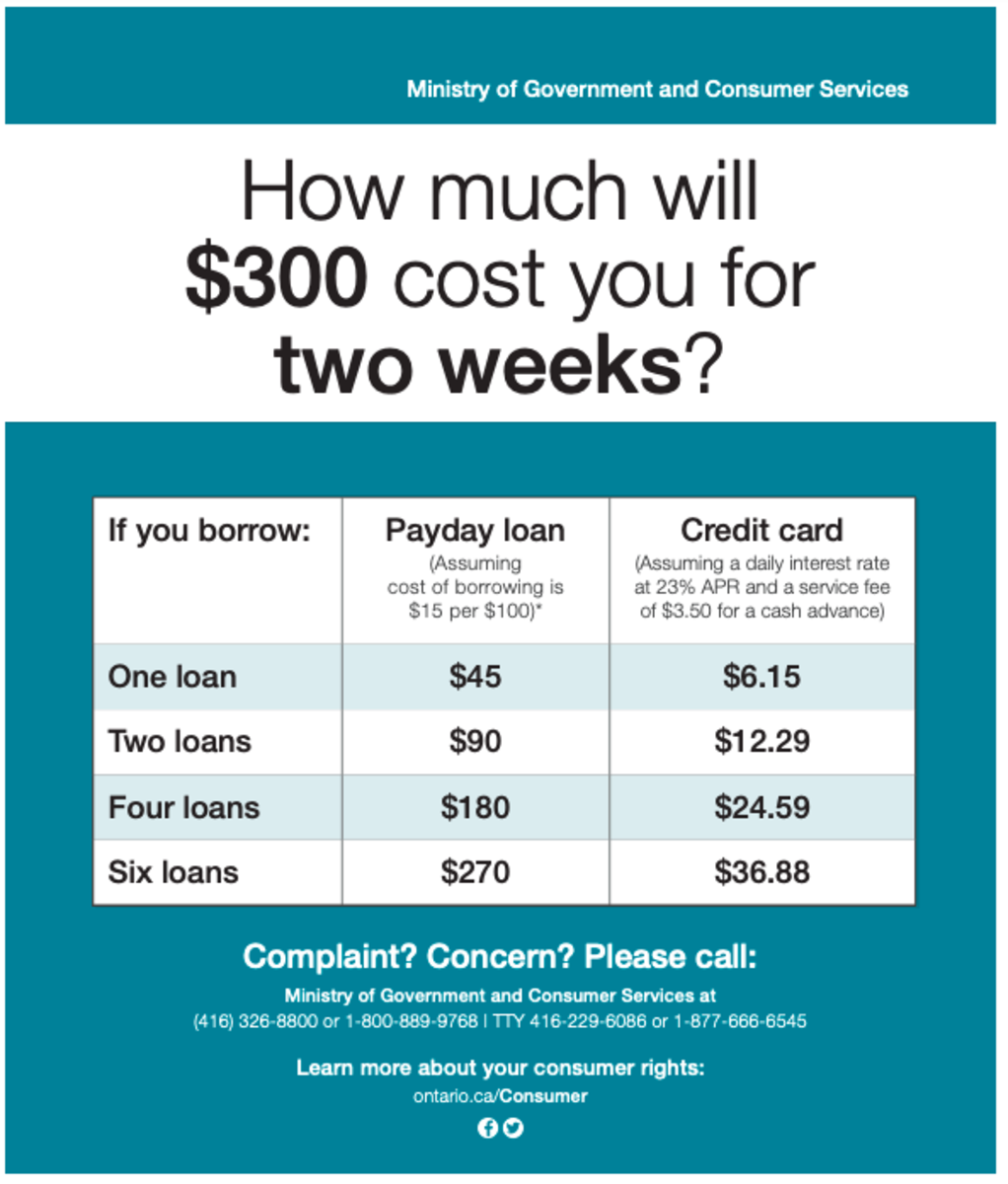

Why You Should Never Get A Payday Loan Canadian Edition Hubpages

Calculating The Home Mortgage Interest Deduction Hmid

Open Sat 1 4 302 1400 Real Estate Victoria

Herald Union Aug 29 2013 By Advantipro Gmbh Issuu

American Economic Association

Trei Real Estate Poland Receives 51 Million Loan From Pbb Property Forum News

Silicon Valley Bank Fallout Spells Additional Trouble For Commercial Real Estate Industry The Business Journals

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Heidelberger Spieleverlag Hr019 Spieleverlag Unicorn Fever Board Game Amazon De Toys

Exv99